One piece of sci-fi technology that doesn’t get much talk these days is gene drives. When I was an up and coming biology student, these were the subject of every seminar, the case study of every class, and they were going to eliminate malaria worldwide.

Now though, you hardly hear a peep about them. And I don’t think, like some of my peers, that this is because anti-technology forces have cowed scientists and policy-makers into silence. I don’t see any evidence that gene drives are quietly succeeding in every test, or that they are being held back by Greenpeace or other anti-GMO groups.

I just think gene drives haven’t lived up to the hype.

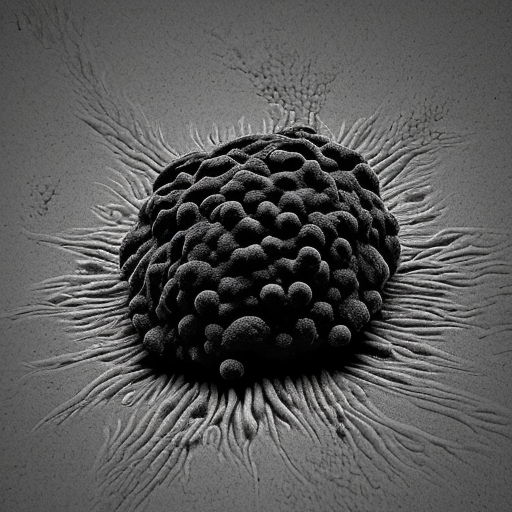

Let me step back a bit: what *is* a gene drive? A gene drive is a way to manipulate the genes of an entire species. If you modify the genes of a single organism, when it reproduces only at most 50% of its progeny will have whatever modification you give it. Unless your modification confers a lot of evolutionary fitness to the organism, there is no way to make every one of the organism’s descendants have your modification.

But a gene drive can do just that. In fact, a gene drive can confer an evolutionary disadvantage to an organism, and you can still guarantee all of the organism’s decedents will have that gene. The biggest use-case for gene drives is mosquitoes. You can give mosquitoes a gene that prevents them from sucking human blood, but since this confers an evolutionary disadvantage, your gene won’t last many generations before evolution weeds it out.

But if you put your gene in a gene drive, you can in theory release a population of mosquitoes carrying this gene and ensure all of their decedents have the gene and thus won’t attack humans. In a few generations, a significant fraction of all mosquitoes will have this gene, thus preventing mosquito bites as well as a whole host of diseases mosquitoes bring.

Now this is a lot of genetic “playing God,” and I’m sure Greenpeace isn’t happy about it. But environmentalist backlash has never managed to stamp out 100% of genetic technology. CRISPR therapies and organisms are on the rise, GMO crops are still planted worldwide, environmentalists may hold back progress but they cannot stop it.

But talk about gene drives *has* slowed considerably and I think it’s because they just don’t work as advertised.

See, to be effective a gene drive requires an evolutionary contradiction: it must reduce an organism fitness but still be passed on to the progeny. Mosquitoes don’t just bite humans for fun, we are some of the most common large mammals in the world, and our blood is rich in nutrients. For mosquitoes, biting us is a necessity for life. So if you create a gene drive that knocks out this necessity, you are making the mosquitoes who carry your gene drive less evolutionarily fit.

And gene drives are not perfect. The gene they carry can mutate, and even if redundancy is built in, that only means more mutations will be necessary to overcome the gene drive. You can make it more and more improbable that mutations will occur, but you cannot prevent them forever. So when you introduce a gene drive, hoping that all the progeny will carry this gene that prevents mosquitoes biting humans, eventually one lucky mosquito will be born that is resistant to the gene drive’s effects. It will have an evolutionary advantage because it *will* bite humans, and so like antibiotic resistant bacteria, it will grow and multiply as the mosquitoes who still carry the gene drive are outcompeted and die off.

Antibiotics did not rid the world of bacteria, and gene drives cannot rid the world of mosquitoes. Evolution is not so easily overcome.

I tell this story in part to tell you another story. Social media was abuzz recently thanks to a guerilla marketing campaign for a bacteria that is supposed to cure tooth decay. The science can be read about here, but I was first alerted to this campaign by stories of an influencer who would supposedly receive the bacteria herself and then pledged to pass it on to others by kissing them. Bacteria can indeed be passed by kissing, by the way.

But like gene drives, this bacteria doesn’t seem to be workable in the context of evolution. Tooth decay happens because certain bacteria colonize our mouth and produce acidic byproducts which break down our enamel. Like mosquitoes, they do not do this just for fun. The bacteria do this because it is the most efficient way to get rid of their waste.

The genetically modified bacteria was supposed to not produce any acidic byproducts, and so if you colonized someone’s mouth with this good bacteria instead of the bad bacteria, their enamel would never be broken down by the acid. But this good bacteria cannot just live in harmony and contentment, life is a war for resources and this good bacteria will be fighting with one hand tied behind its back.

Any time you come into contact with the bad bacteria, it will likely outcompete the good bacteria because it’s more efficient to just dispose of your waste haphazardly than it is to wrap it in a nice, non-acidic bundle first. Very quickly the good bacteria will die off and once again be replaced by bad bacteria.

So I’m quite certain this little marketing campaign will quietly die once its shown the bacteria doesn’t really do anything. And since I’ve read that there aren’t even any peer reviewed studies backing up this work, I’m even more certain of its swift demise.

Biology has brought us wonders, and we have indeed removed certain disease scourges from our world. Smallpox, rinderpest, and hopefully polio very soon, it is possible to remove pests from our world. But it takes a lot more work than simply releasing some mosquitoes or kissing someone with the right bacteria. And that’s because evolution is working against you every step of the way.