-

Tau vs A-beta in Alzheimer’s disease

There remains, in the medical community, a disagreement over what exactly causes Alzheimer’s disease. If you even look at what kinds of drugs people are trying to make to treat the disease, there is no consensus on what mechanism the drugs should target.

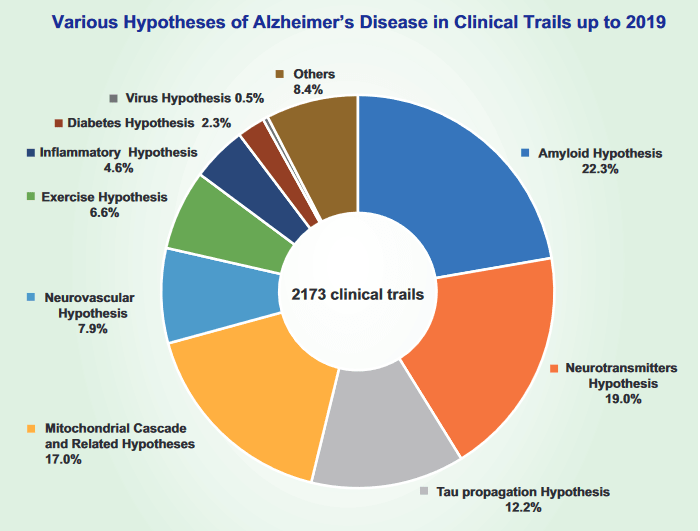

The above picture was taken from “History and progress of hypotheses and clinical trials for Alzheimer’s disease” by Liu et al in 2019. This picture shows all the different clinical trials being run on Alzheimer’s disease, and all the different kinds of drugs people are using in those clinical trials. What’s interesting is that those drugs don’t all target the same or even similar things. Some drugs target Amyloid Beta, some target Tau, some target things you may never have heard of, like Neurotransmitters or the Mitochondrial Cascade. In most diseases we know what causes the disease, ever drug that has a clinical trial to treat COVID will in some way be targeting the coronavirus itself, because that’s what causes COVID. But there is no consensus on what causes Alzheimer’s disease, so the drugs that are in clinical trials all target completely different things.

With no consensus, it’s hard to see a path forward for both research and drug discovery. There are a number of antibody-based drugs on the market today which are supposed to clear our either Amyloid Beta plaques or Tau tangles, but there’s no consensus in the field if those are even the causative agents of Alzheimer’s disease. So if you’re a drug company investigating this, you’d making a bet not only that your product will do what it’s supposed to (clear out tangles and plaques) but you’re ALSO making a bet that you know the One True Cause of Alzheimer’s disease and that 70% or researchers are just wrong when they think the causative agent might be something else.

I’m not saying this is entirely a bad thing, I think it’s good that researchers and drug discovery companies are willing the gamble big to cure Alzheimer’s disease, despite knowing that the science isn’t even settled on what causes Alzheimer’s disease. But I am saying that I’m not exactly surprised that we’ve been studying this for decades with no effective cures in sight.

-

Stock buybacks are very similar to dividends

There’s an old saying in the Tech industry: “Tech companies only give dividends when they have nothing better to do with their money.” It’s been used as an explanation for why so many Tech companies don’t have dividends, and why that’s a good thing: they’re spending their money in better ways which should bring more value to the investors. Yet this is honestly nothing more than a lie: Tech companies don’t give dividends because they found a more tax-efficient way to give money to investors: buybacks.

Amazon is the poster child for buybacks instead of dividends. It has long defended its no dividends policy by saying it spends all its money on capital expansion (ie growing the business). And to be honest it has posted impressive growth numbers for years. But while it has never given a dividend, it has almost always used a buyback.

A buyback of stock, like a dividend, is merely a way for the company to hand value back to its investors. The company floods the market with asks for its stock which raises the stock price, and those investors who wish to cash out can now do so at the higher price. It’s no secret that buybacks increase a stock’s price, pretty much everyone who isn’t economically illiterate understands this, what is less understood is why Amazon uses them instead of dividends.

Dividends are an unavoidable capital gain for investors, unless the stock is held in a preferential account (an IRA or 401k) the investor will have to pay tax on the dividends. A stock buyback though, only creates realized gains for the investors who do want to cash out, and they were going to take a realized gain anyway. For everyone who wants to hold the stock, a buyback raises their stock price without them having the realize the profit, the investors become measurably richer but don’t get taxed. Stock buybacks were illegal until 1982, which is a damn good reason for why most “boomer” companies (Coke, Ford, Boeing) never got into them. Tech companies like Amazon and Google were incorporated in the 90s though, and once they IPO’d management quickly became aware of the tax benefits to buybacks over dividends. For these tax reasons, Tech companies perform buybacks instead of dividends, while giving lip service to the idea that they’re actually fully committed to capital expansion and not shareholder value.

Make no mistake, Amazon, Tesla, and other growth companies are just as committed to shareholder value as Intel and Ford if for no other reason than to enrich Bezos, Musk and the other major investors. They do so with buybacks instead of dividends because it’s more efficient tax-wise, but they are still committed to handing money back to their shareholders. If congress presses ahead with raising taxes on buybacks, we may see a change, or if Amazon and Tesla’s growth begin to slow their shareholders may start to demand a true dividend in addition to buybacks. Either way the shareholders will always be compensated, that’s just how companies work.

-

Can retail investors make money in real estate?

Maybe not

This is going to be a kind of short post that may prove me to be a dumbass, but I’ve been thinking about real estate and I wanted to talk about it.

For background, I had a friend at work who had to quit her job and move back to her hometown because she could no longer afford rent in the city. She had a steady job at a big research university but it just didn’t pay her rent and so she moved away. I was saddened by both her loss (since she could no longer do the job she loved) and the loss to science, how many other bright minds have been pushed away by low pay and the cost of living crisis?

But it also got me thinking. I’ve talked before about how dividends are supposed to help cure inflation. The housing crisis is caused by a lack of housing supply, and this should mean that housing investors are making bank (much like oil investors). While we think of housing investors as just the individuals who own their own home, the landlords who own most of America’s rental stock are often incorporated and can be invested in. A common investment vehicle for investing in these companies are REITs (real estate investment trusts), which are often publicly traded just like stocks and ETFs. So if landlords are making bank, then REITs should be making bank, so people investing in REITs should also make bank, right? Maaaaaaaybe not.

I did a quick scan of popular REITs and for whatever reason almost all of them seem like strong underperformers. A REIT invests in the real estate market much like an ETF invests in the stock market, and you can grade how well a REIT or ETF is doing by a few metrics, such as alpha, beta, and Sharpe ratio. Note that all REITs and ETFs will be graded relative to a chosen index, $VOO is an ETF that seeks to track the performance of the S&P 500 so it is graded relative to that index. REITs track the performance of the housing market and so will be graded according to a housing market index. Anyway let’s start with alpha, this tells us how much better or worse the fund is doing than it’s chosen index. If $VOO goes up more than the S&P 500, then it has a positive alpha, if it goes down more than the S&P 500 then it has a negative alpha. Beta is a measurement of volatility, $VOO may track the S&P over time, but if it swings wildly up and down (moreso than the S&P) then it will have a higher beta. The Sharpe ratio then is a measurement of reward relative to risk. A higher Sharpe ratio means the ETF or REIT has over-performed on a risk-reward basis, and a lower Sharpe ratio means it has underperformed.

What does this all mean for REITs? They all seem to underperform. The most popular REITs I could find online all had negative alpha (meaning they underperformed their index) and surprisingly low Sharpe ratios of below 0.2 (meaning they weren’t stellar on a risk-reward basis either). Compare that with the most popular ETFs out there, $VOO (mentioned above) has about 0 alpha and a Sharpe ratio of 0.5, meaning it tracks its index almost exactly and is at least OK on a risk/reward basis. $QQQ (another popular ETF, this one tracking the NASDAQ) has a positive alpha (overperforms its index) and a Sharpe ratio of 0.6. Add to this that the stock market has higher expected returns than real estate (meaning you’d expect $VOO and $QQQ to do better than REITs anyway) and it doesn’t look like REITs are a good investment. Past performance does not determine future performance and all that, but the real estate market would have to moon while the stock market tanked for me to expect these REITs to overperform the most popular ETFs.

So it seems that despite skyrocketing housing costs, it’s hard for a retail investor to make money on real estate. I’m not sure who exactly is making money on real estate, if the landlords are making money then it isn’t coming back to the investors, and if the builders/maintainers are making money then it isn’t coming back to their investors either. It seems at this point that the housing market is hurting us all in ways we can’t even make money off of.

-

What did you eat for Thanksgiving?

This year was a weird Thanksgiving since we had a vegetarian guest with us, but my family made build-your-own pizzas (with plenty of vegetable options for our guest) plus vegetarian snacks like falafel and Indian mixed snacks. Then we had apple pie and brownies for dessert (pretty American). We don’t always or even usually have the traditional ham/turkey so this wasn’t totally out of the ordinary for us. I remember one time we made sushi for Thanksgiving (sushi rice is hard to cook if you’re on your own but a lot easier with help) and I think we may have had pizza for Thanksgiving before this.

The traditional ham/turkey Thanksgiving is definitely not bad, I’d really enjoy it for next year, but I also like the fact that we can sometimes just do whatever we want instead. I like a little variety, especially with friends coming over.

-

Difficult post: what even is imposter syndrome?

There’s an old joke about a guy going to a fancy party. The party was attended by only the richest and most famous Americans, from Hollywood stars to CEOs of companies to national politicians, so the guy wasn’t sure he really belonged. He voiced his concern to another guy he met at the party saying “I’m not sure what I’ve done to be invited to this, I mean unlike most folks here I didn’t do anything myself, I was only doing what they told me to do.” The other guy says to him “well sure Neil, but most of us never walked on the Moon.”

It’s an old joke but it gets to the heart of what’s been called “imposter syndrome,” people thinking that they aren’t as special or as capable or as important as they really are, people who despite their long list of achievements feel like “imposters” when people congratulate them or talk glowingly about them. It’s been said that this is especially common in Academia, but I don’t know if I buy that since I’ve only been told that factoid by Academics. Every industry thinks they’re special and unique, and I don’t know if a poll or study would find imposter syndrome to be any more common in Academia than in Journalism, Tech, or any other white collar field.

But what if you really are an imposter? What if you really aren’t as good as people think you are, your work isn’t as deserving of praise as what it gets, and you’re just hanging on with the certainty that any deep look at your work would show you for what you really are. I know for a fact that Academics aren’t usually of the ability of looking closely at each others’ work, the sheer number of retracted papers each year speaks to the fact that even the journals and committees that are paid to keep out imposters don’t work all the time. And beyond retractions there’s always a truism that you don’t know someone else’s work as well as you do your own. So when I feel like my work just isn’t good enough and feel helpless not knowing how to improve that, platitudes about “well everyone feels imposter syndrome” aren’t necessarily the solution.

When something fails in science, you can either overturn the hypothesis or conclude that you did the experiment wrong. When something fails again and again in science, you either have strong evidence that the hypothesis is wrong or strong evidence that you’re really bad at doing the experiment. If everyone but you is able to do the experiment and get the results, then the hypothesis is probably correct. That’s what it feels like sometimes in the lab, I have no reason to believe that my experiment is wrong because I see others have been able to do it flawlessly. And so I can only conclude that I’m really bad at doing the experiment, meaning maybe I’m not cut out for doing this “science” thing.

I just don’t know what I could be doing wrong. If I had some idea then I could design some experiment to determine if I’m doing it wrong or if my sample is wrong or if my hypothesis is wrong. But I have no reason to doubt the hypothesis, little reason to doubt the sample, and all the reason in the world to doubt my own abilities. I know I have my flaws, I’m lacking in manual dexterity and attention span, I have poor motivation when things don’t work and this sometimes leads me to doing more bad work because the work I did just prior was bad. So I’m not sure if I’m the problem or if something else is the problem, and I’m not sure what that says about me in science.

-

我觉得不太好

我觉得不太好。我的工作现在不太好,我做的时候不好可是我不知道为什么。 我应该净化这些蛋白质可是我只净化错的蛋白质。我的ferritin帖子是因为我不知道什么净化真的蛋白质,我每一天试一下净化真的蛋白质我只找得到ferritin。所以那时我的问题。

我的电脑只可以写简体字,可是最多的我的中文说的朋友是台湾人,他们用繁体字。所以我希望他们不是offended我在用简体字。

-

Does anyone know how to remove Ferritin from a sample by differential centrifugation?

Seriously, that’s all I’ve worked on this week.

-

Can’t think of anything to post

Today I’m having problems because my science isn’t working and I don’t know why. Obviously when science isn’t working it’s time to try something different, but what?

The question is, is the problem that my protocol doesn’t work (change the protocol!) or is the problem that I am unable to do the protocol right (how could I fix this?). I don’t know the answer and it’s really making me stressed.

So I’ll instead write an incomprehensible poem

油危

冬天

总统说

“穿毛衣”

-

It’s easy to support a boycott that would never affect you

I know a guy who, after the Dobbs decision (which overturned Roe v Wade this year), said that red states that ban abortion need to be boycotted (this was not an uncommon suggestion in Liberal spaces). I asked him yesterday what he was up to and he said “oh, just watching the World Cup in Qatar.”. It’s very easy to call for boycotts of things you’d never pay for anyway. if you have no interest in going to Arkansas then you can call for a boycott of Arkansas and feel smug that you’re standing up for human rights. But it’s much harder to obey a boycott for something you like, if the World Cup we’re being held in Arkansas then I know millions of pro-choice pro-LGBT people who would put their morals aside just to watch.

I will not be watching this year’s World Cup. But with how may people I know who will be watching, people who called for boycotts just earlier this year, it’s become clear to me that those calls for boycotts were purely performative, with zero moral backing behind them.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.